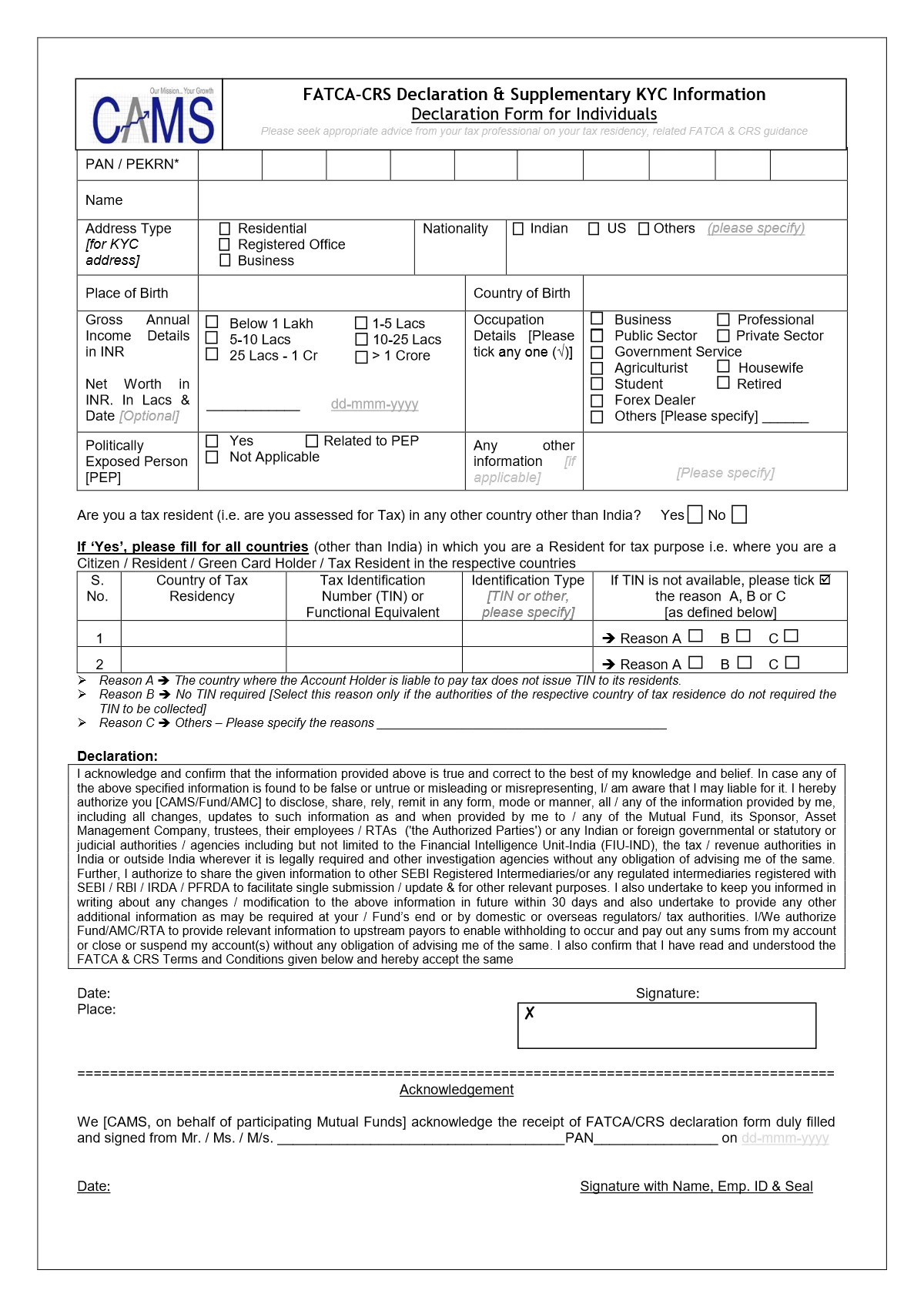

CAMS FATCA Form

The FATCA (Foreign Account Tax Compliance Act) form provided by CAMS (Computer Age Management Services) is a declaration that investors need to fill out to comply with FATCA regulations.

FATCA is a U.S. tax law aimed at preventing tax evasion by U.S. persons through foreign accounts.

Details to be Mentioned in CAMS FATCA Form

- Investor Information:

- Name

- PAN (Permanent Account Number)

- Address

- Date of Birth

- Nationality

- FATCA/CRS Declaration:

- Tax residency status

- Country(ies) of tax residence

- Tax Identification Number (TIN) for each country of residence

- If the individual is a U.S. person (U.S. citizen or resident)

- Declarations and Signatures:

- Confirmation of the accuracy of the provided information

- Signatures of the investor(s) or authorized signatories

Required Documents

- Proof of Identity (Any one of the following):

- PAN Card

- Passport

- Aadhaar Card

- Voter ID Card

- Proof of Address (Any one of the following):

- Passport

- Aadhaar Card

- Utility Bill (electricity, telephone, etc.)

- Bank Statement

- Tax Identification Number (TIN) Proof (if applicable):

- Documents showing TIN for all countries of tax residence other than India

- Additional Documents for U.S. Persons:

- W-9 form (Request for Taxpayer Identification Number and Certification) for U.S. persons