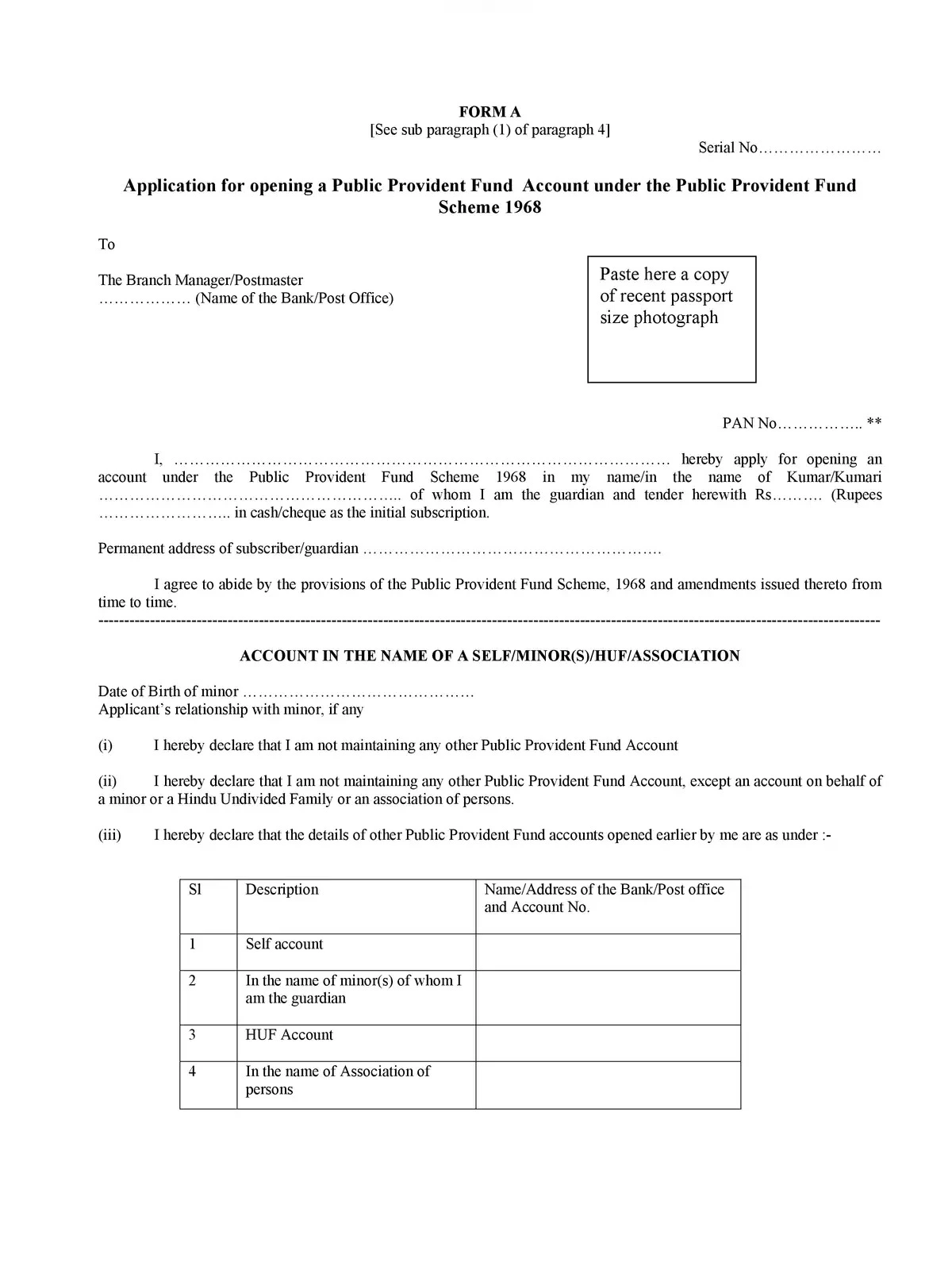

Post Office PPF Account Opening Form

The Public Provident Fund (PPF) is a well-known savings plan with guaranteed returns and tax advantages. The government permits customers to open a PPF account through India Post Offices to make PPF accessible to everyone, especially those in distant places.

Post Office PPF Account Form Eligibility

- A PPF account can be opened at a post office by any resident Indian, including salaried, self-employed, pensioners, and others.

- An individual’s total number of PPF accounts, including post office PPF accounts, is limited to one, and joint operations are not permitted.

- A parent or guardian can open a minor PPF account on behalf of a minor kid at a post office. This, too, is limited to one PPF account for minors per child.

- A new PPF account cannot be opened by a non-resident. However, if a resident Indian becomes an NRI before the PPF account matures, he or she can continue to use the account until it matures.

Document Required to Open PPF Account in Post Office

- Identity Proof

- Pan Card

- Address proof

- Photograph

- Nomination form – Form E