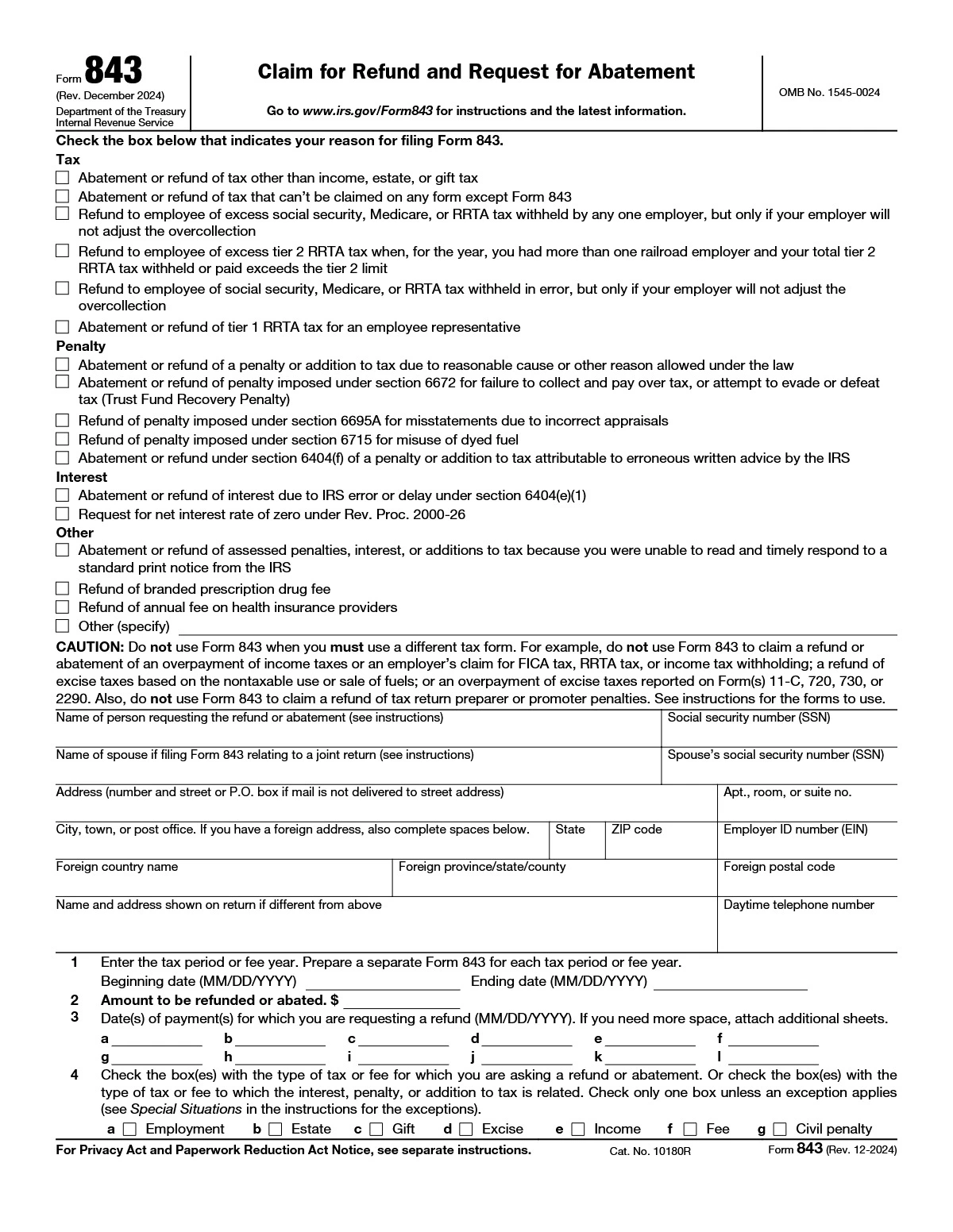

IRS Form 843 – Claim for Refund and Request for Abatement

Who Can File?

You can file Form 843 or your authorized representative can file it for you. If your authorized representative files Form 843, the original or copy of Form 2848, Power of Attorney and Declaration of Representative, must be attached. You must sign Form 2848 and authorize the representative to act on your behalf for the purposes of the request. See the Instructions for Form 2848 for more information.

If you are filing as a legal representative for a decedent whose return you filed, attach to Form 843 a statement that you filed the return and you are still acting as the decedent’s representative. If you did not file the decedent’s return, attach certified copies of letters testamentary, letters of administration, or similar evidence to show your authority. File Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer, with Form 843 if you are the legal representative of a decedent. See the instructions for Form 1310 for full details.

IRS Form 843- Where to File

| If you are filing Form 843… | Then mail the form to… |

|---|---|

| In response to an IRS notice regarding a tax or fee related to certain taxes such as income, employment, gift, estate, excise, etc. | The return address from which the notice was sent. |

| To request a claim for refund in a Form 706 (Estate Tax Return) or Form 709 (Gift Tax Return) tax matter | Internal Revenue ServiceAttn: E&G, Stop 824G7940 Kentucky DriveFlorence, KY 41042-2915 |

| In response to Letter 4658 (Branded Prescription Drug Fee) | Internal Revenue ServiceMail Stop 4921 BPDF1973 N. Rulon White Blvd.Ogden, UT 84201-0051 |

| In response to Letter 5067C (Annual Fee on Health Insurance Providers Final Fee) | Internal Revenue ServiceMail Stop 4921 IPF1973 N. Rulon White Blvd.Ogden, UT 84201 |

| For requests of a net interest rate of zero | The service center where you filed your most recent return. |

| As a nonresident alien requesting a refund of Social Security or Medicare taxes withheld in error from pay that is not subject to these taxes | The address in Pub. 519 for nonresident aliens requesting such refunds. Follow the specific instructions in Pub. 519. |

| For requests related to Form 8300 (Report of Cash Payments Over $10,000 Received in a Trade or Business) | Internal Revenue ServiceRosa Parks Federal BuildingP.O. Box 32621Detroit, MI 48232 |

| For penalties, or for any other reason except those described above | The service center where you would be required to file a current year tax return for the tax to which your claim or request relates. See the instructions for the return you are filing. |