UCO Bank Form 15G

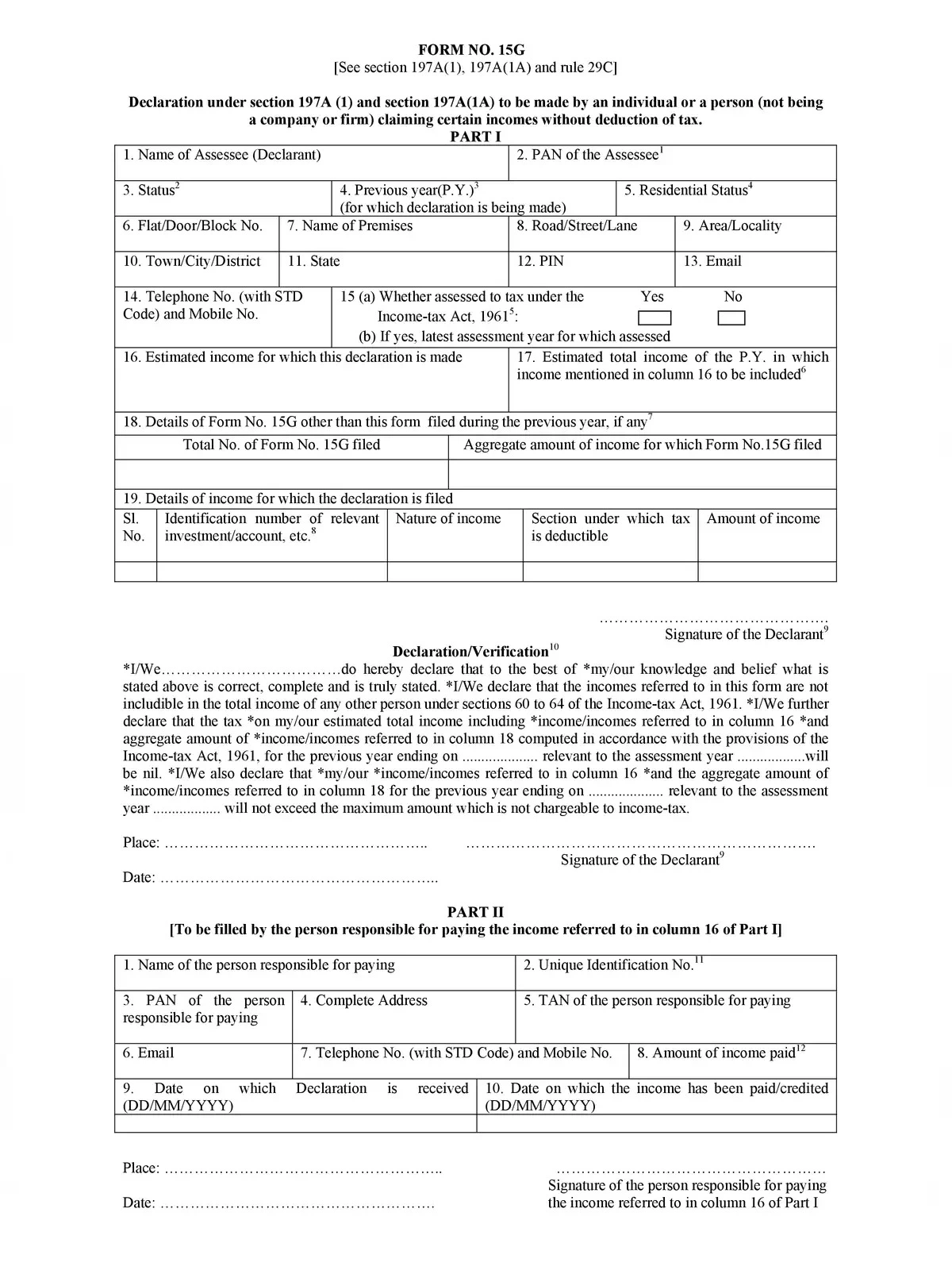

Form 15G is an essential declaration that individuals under 60 years of age and Hindu Undivided Families (HUF) can fill out to ensure that no TDS (Tax Deduction at Source) is deducted from their interest income for the fiscal year. This form is crucial for bank fixed deposit holders who want to avoid TDS on their earnings.

Form No. 15G or 15H are self-declaration forms that individuals can provide to state that their income is below the taxable limit, which means that no TDS should be deducted. It’s important to note that if the provident fund is withdrawn before completing five years of service, a TDS of 10 percent will be deducted from June 1, 2015.

Essential Information for UCO Bank Form 15G

To successfully fill out UCO Bank Form 15G, you need to provide several mandatory details:

- Name of Assessee (Declarant)

- PAN of the Assessee

- Status

- Residential Status

- Previous Year (P.Y.) for which the declaration is being made

- Name of Premises

- Telephone No

- Estimated income for which this declaration is made

- Estimated total income of the P.Y. in which income mentioned in column 16 to be included

- Details of Form No. 15G other than this form filed during the previous year, if any

- Details of income for which the declaration is filed

- Signature of the Declarant

You can easily download other UCO Bank Forms PDF from bankformpdf.in.

For your convenience, you can download the UCO Bank Form 15G in PDF format using the link provided below. Don’t miss out on this opportunity to manage your finances effectively and ensure you don’t pay unnecessary taxes!