Axis Bank NEFT Form 2026

Axis Bank NEFT Form: NEFT (National Electronic Funds Transfer) is a popular electronic payment system used in India for transferring funds between banks. When you want to initiate an NEFT transaction, you typically fill out a form provided by your bank.

Axis Bank NEFT Form – Overview

| Type of Form | Axis Bank NEFT Application Form |

| Name of Bank | Axis Bank |

| Official Website | https://www.axisbank.com/ |

| Uses of Form | Online Transfer of Funds |

| Minimum Limit | No minimum limit for NEFT |

| Maximum Limit | No limit |

| Beneficiary | Bank Customers |

| Form Language | English, Hindi |

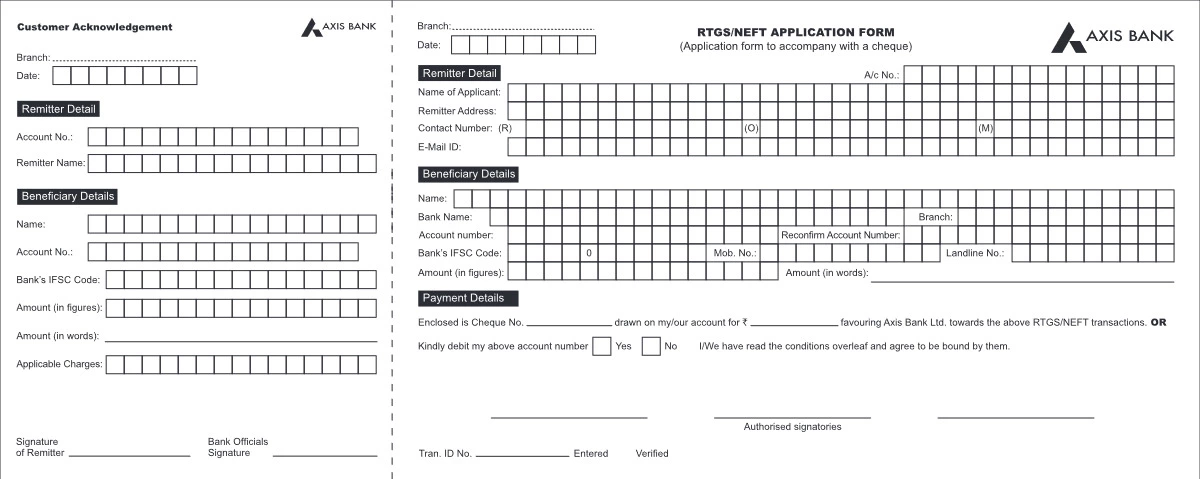

Axis Bank NEFT Form – Details to be Mentioned

- Sender Details: This includes your personal information such as your name, address, contact number, and often your bank account number.

- Beneficiary Details: You need to provide the details of the person or entity you’re transferring funds to. This includes their name, bank account number, bank name, branch name, and sometimes the IFSC (Indian Financial System Code) of the beneficiary bank branch.

- Amount to be Transferred: You specify the amount you want to transfer.

- Date of Transfer: You can choose the date on which you want the transfer to be initiated. NEFT transactions are typically processed in batches, so the exact timing of the transfer may vary.

- Purpose of Transfer: You may be asked to specify the reason for the transfer, such as personal, business, payment for goods/services, etc.

- Authorization: You need to sign the form to authorize the bank to initiate the transfer from your account.

- Charges: NEFT transactions often have associated charges. The form may specify these charges, or they may be deducted directly from your account.

- Declaration: Some forms may include a declaration section where you confirm the accuracy of the information provided and agree to the terms and conditions of the NEFT transaction.

Axis Bank NEFT Charges

The charges for Axis Bank’s NEFT and RTGS services are shown below in the Table,

| NEFT Outward | Outward Up to Rs. 10,000/- | Rs.2.50/- per transaction |

| Rs. 10001 to Rs 1 Lakh | Rs. 5/- per transaction | |

| Rs 1 Lakh to Rs 2 lakh | Rs. 15/- per transaction | |

| Above Rs.2 Lakh | Rs.25/- per transaction |