HDFC RTGS (NEFT) Form 2026

The HDFC RTGS (Real Time Gross Settlement) form is used to initiate electronic funds transfers between different banks in India. HDFC Bank offers different electronic methods of fund transfer via its Internet banking and mobile banking. One among these is NEFT services that can be used for easy fund transfer.

HDFC RTGS Form – Highlights

| Type of Form | RTGS/NEFT Form |

| Name of Bank | HDFC Bank |

| Official Website | https://v1.hdfcbank.com/ |

| Language | English |

| Uses of Form | Online Transfer of Funds |

| Minimum Limit | 2 Lacs |

| Fess & Charges |

|

| Maximum Limit | No limit |

| Beneficiary | Bank Customers |

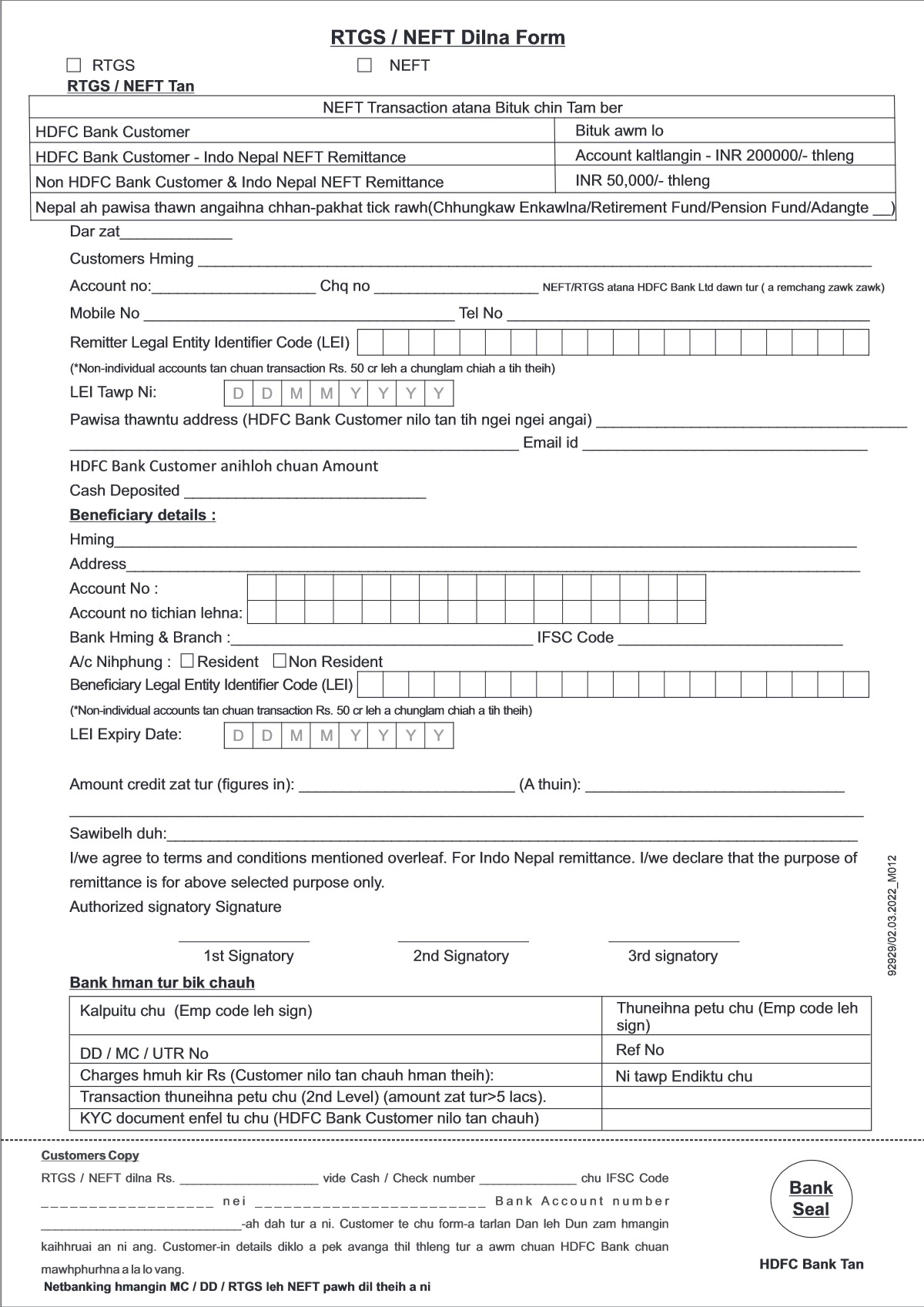

HDFC RTGS Form – Details to be Mentioned

- Sender Details: This section requires you to fill in your personal details such as your name, address, contact number, and account number from which the funds will be debited.

- Recipient Details: Here, you’ll provide details about the recipient, including their name, address, contact number, and account number to which the funds will be credited. You’ll also need to provide the IFSC (Indian Financial System Code) of the recipient’s bank branch.

- Amount to be Transferred: Specify the amount you wish to transfer in figures and words.

- Purpose of Remittance: You might be asked to mention the reason for the transfer, such as payment for goods/services, loan repayment, etc.

- Date of Transfer: You’ll indicate the date on which you want the transfer to take place. For RTGS transactions, funds are transferred in real-time, so the date specified is usually the current date.

- Charges: RTGS transactions typically involve charges, which could be borne either by the sender, the recipient, or shared. This section clarifies who will bear the charges.

- Authorization: Signatures of the sender are usually required to authorize the transaction.

- Declaration: You may need to declare that the information provided is accurate and that you understand the terms and conditions of the RTGS transaction.

HDFC RTGS/NEFT Form – Online Apply Procedure

If you are making use of the online RTGS facility, then here are the steps you need to follow:

- You will need to have your user ID and password ready

- Go to your bank’s official website – https://v1.hdfcbank.com/

- Log in to the net banking account – Link

- Once you log in, add the details of the beneficiary if you have not added the details

- Once the details of the beneficiary are added, you will need to go to the option for RTGS transactions

- Enter the details of the beneficiary and the payment to be processed to make the transactions

- Submit the application and the funds will be transferred to the beneficiary instantly

Documents Required for HDFC NEFT/RTGS Form

- RTGS/NEFT Application Form

- Cheque leaf

- And any other documents