SBI RTGS Form 2025

RTGS stands for Real Time Gross Settlement. It is a system for large-value interbank funds transfers that are settled in real time. When you make an RTGS transfer, the money is transferred instantly from one bank to another on a gross basis, meaning each transaction is settled individually and not bundled with other transactions.

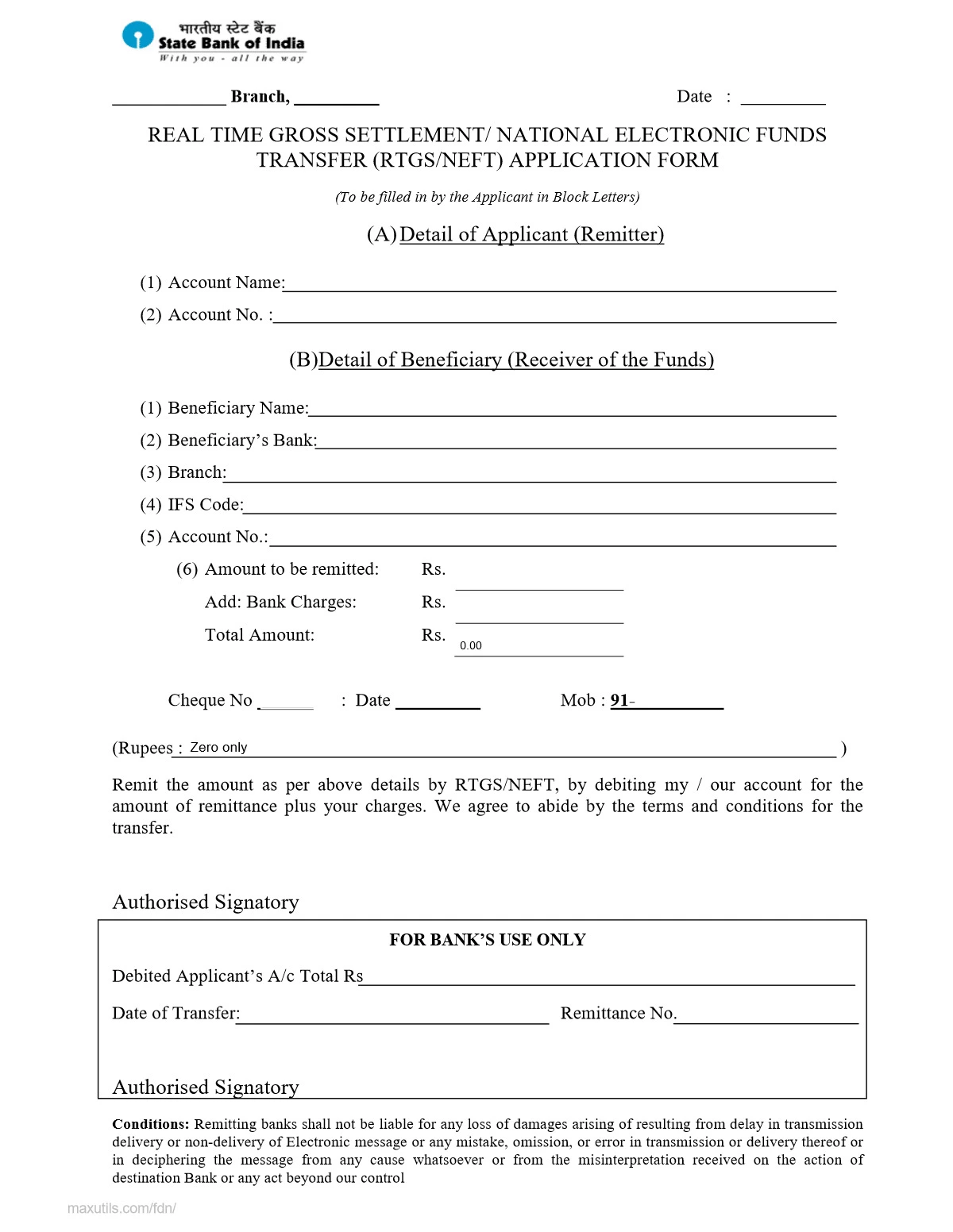

In SBI RTGS form includes details of the person or entity initiating the transfer, such as their name, address, contact information, and account number. details of the recipient’s bank, including the bank’s name, branch, address, and the recipient’s account number

SBI RTGS Form Highlights

| Type of Form | RTGS NEFT Application Form |

| Name of Bank | SBI Bank |

| Official Website | onlinesbi.com |

| Uses of Form | Online Transfer of Funds |

| Minimum Limit | The minimum limit is Rs. 2 lakhs for RTGS, No minimum limit for NEFT |

| Maximum Limit | No limit |

| Beneficiary | Bank Customers |

| Form Language | English, Hindi |

SBI Bank RTGS/NEFT Apply online

If you are making use of the online RTGS facility, then here are the steps you need to follow:

- You will need to have your user ID and password ready

- Go to your bank’s official website

- Log in to the net banking account – Link

- Once you log in, add the details of the beneficiary if you have not added the details

- Once the details of the beneficiary are added, you will need to go to the option for RTGS transactions

- Enter the details of the beneficiary and the payment to be processed to make the transactions

- Submit the application and the funds will be transferred to the beneficiary instantly