80C Deduction List

Section 80C provides deduction in respect of various items like life insurance premium, investment in Public Provident Fund, investment in NSC, repayment of principal component of housing loan, investment in Post Office Time Deposit Scheme, Senior Citizens Saving Scheme, etc. We will focus on the provisions of section 80C relating to deduction on account of payment of life insurance premium

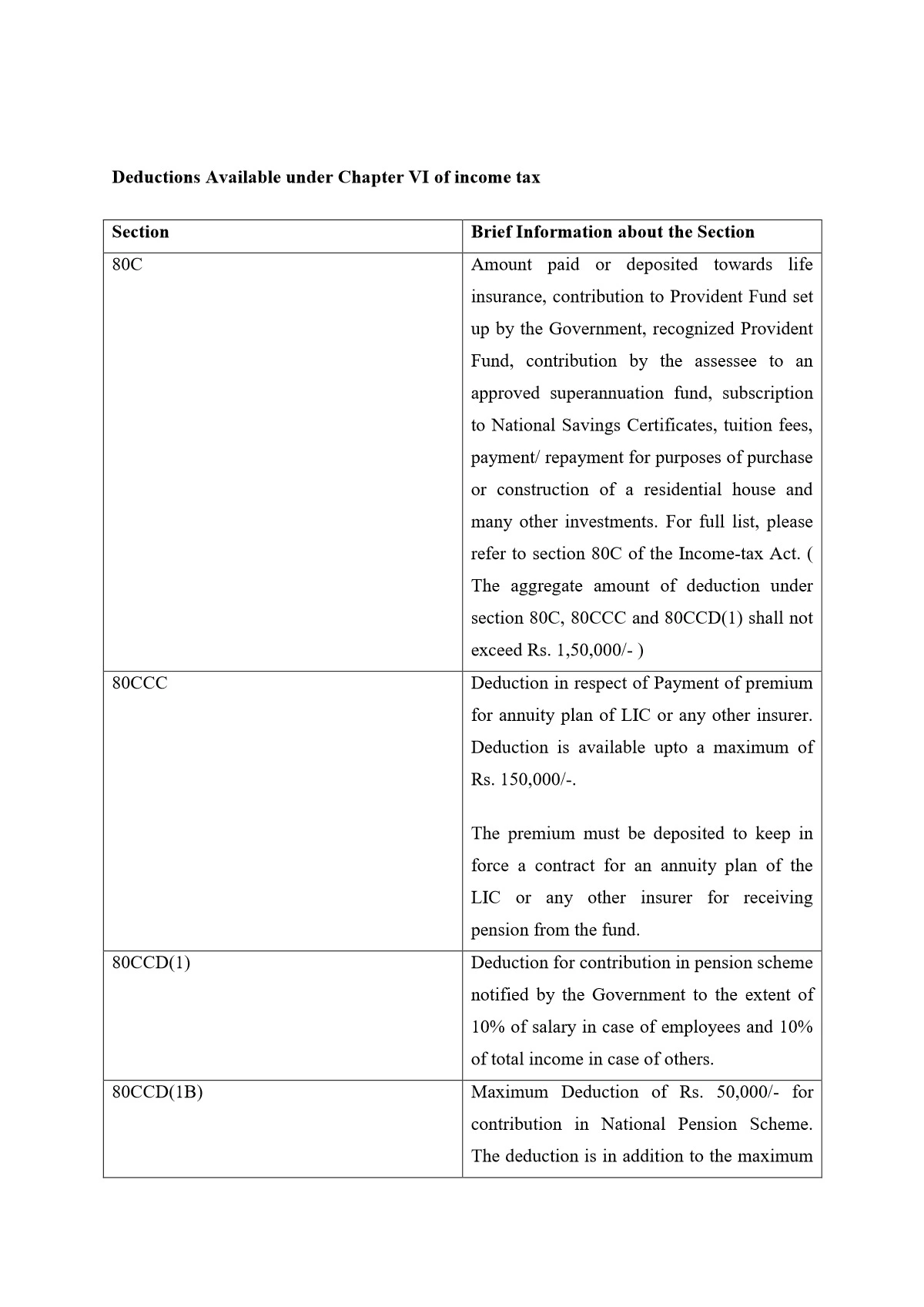

Income Tax Deduction Limit under Section 80C, 80CCC, 80CCD(1), 80CCE, 80CCD(1B)

| Sections | Eligible investments for tax deductions | Maximum Deduction |

|---|---|---|

| 80C | Investment made in Equity Linked Saving Schemes, PPF/SPF/RPF, payments made towards Life Insurance Premiums, principal sum of a home loan, SSY, NSC, SCSS, etc. | Rs 1,50,000 |

| 80CCC | Payment made towards pension funds | Rs 1,50,000 |

| 80CCD(1) | Payments made towards Atal Pension Yojana or other pension schemes notified by government | Employed: 10% of basic salary + DA Self-employed: 20% of gross total income |

| 80CCE | Total deduction under Section 80C, 80CCC, 80CCD(1) | Rs 1,50,000 |

| 80CCD(1B) | Investments in NPS (outside Rs 1,50,000 limit under Section 80CCE) | Rs 50,000 |

| 80CCD(2) | Employer’s contribution towards NPS (outside Rs 1,50,000 limit under Section 80CCE) | Central government employer: 14% of basic salary +DA Others: 10% of basic salary +DA |

Deduction Under Section Chapter VIA

| Sections | Income Tax Deduction for FY 2023-24(AY 2024-25) | Eligible person | Maximum deduction available for FY 2023-24(AY 2024-25) |

|---|---|---|---|

| Section 80C | Investing into very common and popular investment options like LIC, PPF, Sukanya Samriddhi Account, Mutual Funds, FD, child tuition fee, ULIP, etc | Individual Or HUF | Upto Rs 1,50,000 |

| Section 80CCC | Investment in Pension Funds | Individuals | |

| Section 80CCD (1) | Atal Pension Yojana and National Pension Scheme Contribution | Individuals | |

| Section 80CCD(1B) | Atal Pension Yojana and National Pension Scheme Contribution (additional deduction) | Individuals | Upto Rs 50,000 |

| Section 80CCD(2) | National Pension Scheme Contribution by Employer | Individuals | Amount Contributed or 14% of Basic Salary + Dearness Allowance (in case the employer is Government) 10% of Basic Salary+ Dearness Allowance(in case of any other employer) – Whichever is lower |

| Section 80D | Medical Insurance Premium, preventive health checkup and Medical Expenditure | Individual Or HUF | Upto Rs 1,00,000 |

| Section 80DD | Medical Treatment of a Dependent with Disability | Individual Or HUF | Normal Disability (at least 40% or more but less than 80%): Rs 75,000/- Severe Disability (at least 80% or more): Rs 1,25,000/- |

| Section 80DDB | Medical expenditure for treatment of Specified Diseases | Individual Or HUF | Senior Citizens: Upto Rs 1,00,000 Others: Upto Rs 40,000 |

| Section 80E | Interest paid on Loan taken for Higher Education | Individual | No limit (Any amount of interest paid on education loan) up to 8 assessment years |

| Section 80EE | Interest paid on Housing Loan | Individual | Upto Rs 50,000 subject to some conditions |

| Section 80EEA | Interest Paid on Housing Loan | Individual | Upto Rs 1,50,000/- subject to some conditions |

| Section 80EEB | Interest paid on Electric Vehicle Loan | Individual | Upto Rs 1,50,000 subject to some conditions |

| Section 80G | Donation to specified funds/institutions. Institutions | All Assessee (Individual, HUF, Company, etc) | 100% or 50% of the Donated amount or Qualifying limit, Allowed donation in cash upto Rs.2000/- |

| Section 80GG | Income Tax Deduction for House Rent Paid | Individual | Rs. 5000 per month 25% of Adjusted Total Income Rent paid – 10% of Adjusted Total Income – whichever is lower |

| Section 80GGA | Donation to Scientific Research & Rural Development | All assessees except those who have an income (or loss) from a business and/or a profession | 100% of the amount donated. Allowed donation in cash upto Rs.10,000/- |

| Section 80GGB | Contribution to Political Parties | Companies | 100% of the amount contributed No deduction available for the contribution made in cash |

| Section 80GGC | Individuals on contribution to Political Parties | Individual HUF AOP BOI Firm | 100% of the amount contributed. No deduction available for the contribution made in cash |

| Section 80RRB | Royalty on Patents | Individuals (Indian citizen or foreign citizen being resident in India) | Rs.3,00,000/- Or Specified Income – whichever is lower |

| Section 80QQB | Royalty Income of Authors | Individuals (Indian citizen or foreign citizen being resident in India) | Rs.3,00,000/- Or Specified Income – whichever is lower |

| Section 80TTA | Interest earned on Savings Accounts | Individual Or HUF (except senior citizen) | Upto Rs 10,000/- |

| Section 80TTB | Interest Income earned on deposits(Savings/ FDs) | Individual (60 yrs or above) | Upto Rs 50,000/- |

| Section 80U | Disabled Individuals | Individuals | Normal Disability: Rs. 75,000/- Severe Disability: Rs. 1,25,000/- |