New Tax Regime Exemption List

The New Tax Regime was introduced with the altered tax slabs and concessional tax rates. It applies to all taxpayers, including individuals, Hindu Undivided Families (HUFs), and Association of Persons (AOPs).

Here are the latest changes in the New Tax Regime:

Standard Deduction and Family Pension Deduction

In the case of salary income, the Standard Deduction of Rs 75,000, which was previously only available under the Old Tax Regime, was extended to the new tax regime. Under the New Tax Regime, you can enjoy a tax-free income of Rs 7.75 lakhs, which is after you apply the standard deduction and tax rebate.

Family pensioners can also benefit from this deduction. The limit of maximum Deduction under Family Pension has been increased from Rs. 15,000 to Rs. 25,000.

Deduction under Section 80CCD(2)

Section 80CCD(2) applies to only salaried individuals and not to self-employed individuals. The deductions under this section can be availed over and above those of Section 80CCD(1).

Section 80CCD(2) allows a salaried individual to claim the following deduction:

Central Government or State Government Employer: Up to 14 percent of their salary (basic + DA)

New Tax Regime Exemption List

- Transport Allowances w.r.t. Person with Disabilities (PwD)

- Conveyance Allowance

- Travel/ Tour/ Transfer Compensation

- Perquisites for Official Purposes

- Exemptions for Voluntary Retirement Scheme u/ Section 10(10C)

- Gratuity Amount u/ Section 10(10)

- Leave Encashment u/ Section 10(10AA)

- Interest on Home Loan on Lent-out Property u/ Section 24

- Gifts of Up to Rs. 5,000

- Employer’s Contributions to Employees NPS Accounts u/ Section 80CCD(2)

- Additional Employee Costs u/ Section 80JJA

- Deductions on Deposits in Agniveer Corpus Fund u/ Section 80CCH(2)

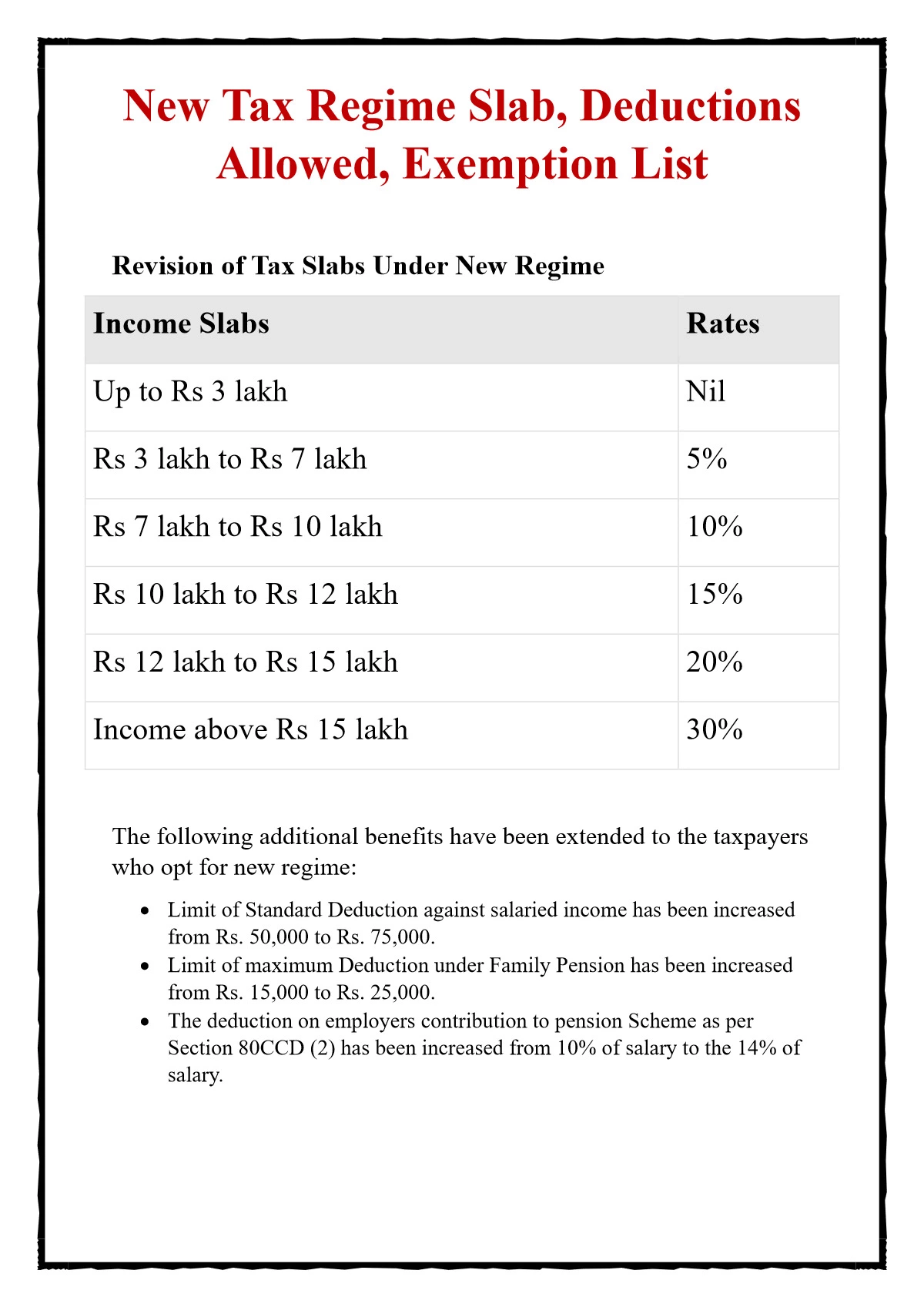

New Tax Regime Slab Rate

| Income Slabs | Rates |

| Up to Rs 3 lakh | Nil |

| Rs 3 lakh to Rs 7 lakh | 5% |

| Rs 7 lakh to Rs 10 lakh | 10% |

| Rs 10 lakh to Rs 12 lakh | 15% |

| Rs 12 lakh to Rs 15 lakh | 20% |

| Income above Rs 15 lakh | 30% |